NATO Arms Imports Surge Amid U.S. Weaponry Dominance

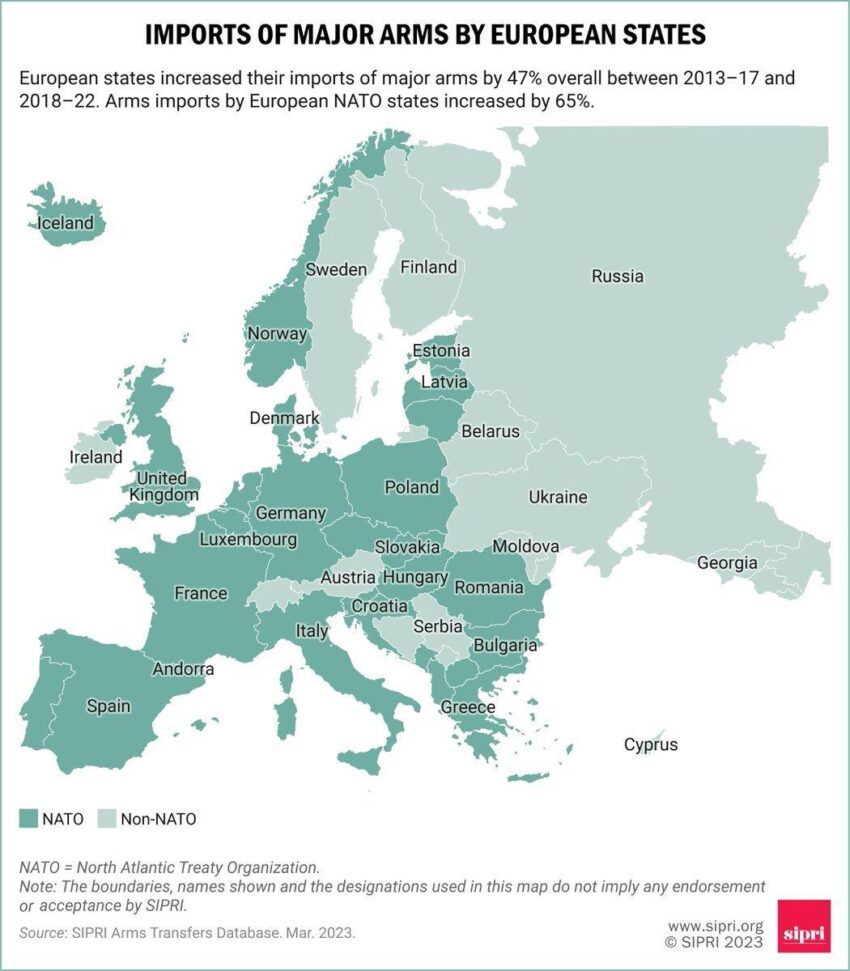

Recent research from the Stockholm International Peace Research Institute (SIPRI) reveals a significant uptick in arms imports among NATO countries in Europe, which have more than doubled over the past five years. Alarmingly, over 60% of these acquisitions are attributed to U.S. weaponry. The findings come on the heels of an announcement by European Union member states, showcasing their intent to bolster defense capabilities in light of shifting U.S. foreign policy under the Trump administration.

Ukraine has emerged as the foremost arms importer in the world from 2020 to 2024, further emphasizing the dynamics of the current global arms market. The United States has affirmed its status as the leading global weapons exporter, making up 43% of worldwide exports and significantly overshadowing France, which holds the position of second-largest exporter with just 9.6%. The surge in arms imports among European NATO members, increasing by 105% over the previous five years, indicates a dedicated rearmament effort in response to perceived threats from Russia.

U.S. Dominance in Arms Supply

Notably, the U.S. supplied 64% of these arms to NATO countries, a notable increase from 52% during the period from 2015 to 2019. Senior researcher Pieter Wezeman attributed this spike to the growing aggressiveness of Russia and the strain of transatlantic relations witnessed during Trump’s presidency. This shift has incited European NATO nations to work towards reducing their dependency on arms imports while simultaneously boosting their own defense industries.

Despite these efforts, the reliance on U.S. military supplies remains deeply entrenched. As Wezeman noted, European NATO states currently have around 500 combat aircraft and significant orders lined up for more U.S. weaponry. Furthermore, nations like Italy and the United Kingdom have integrated American F-35 fighter jets and Patriot missile systems into their arsenals, making replacements challenging due to the complexity of these systems.

Increased Dependence on U.S. Arms

Countries such as Belgium, the Netherlands, and Denmark are becoming increasingly reliant on U.S. military exports. Changing this dependency would necessitate substantial financial and political investment, according to Wezeman. He pointed out that arms procurement typically spans several years, often exceeding the timeframe of a U.S. presidential term, complicating efforts to shift away from American suppliers.

The ramifications of this rise in imports have positioned Europe as the largest market for U.S. weaponry for the first time in two decades. In the 2020-2024 period, European countries accounted for 35% of U.S. arms exports, surpassing the Middle East, which constituted 33%. However, Saudi Arabia still remains the largest single buyer of U.S. military equipment.

Continued U.S. Global Arms Leadership

The U.S. maintains a commanding presence in the global arms trade, accounting for 43% of all arms exports, a share that is more than four times that of France, the second-largest exporter. In contrast, France has tripled its exports to other European nations when compared to the previous five years, fueled primarily by sales of Rafale fighter jets to Greece and Croatia, alongside arms deliveries to Ukraine.

France’s defense portfolio also prominently features India, which comprises 28% of its total exports, nearly double that of all other European countries combined. Although Russia remains the third-largest arms exporter despite a drastic 64% drop in exports between 2020 and 2024, the pressure from international sanctions concerning the Ukraine conflict has influenced Russia’s ability to secure new clients.

Shifting Dynamics and Alternatives

In light of these developments, India, which accounted for 38% of Russian arms exports, is increasingly exploring alternative suppliers. Additionally, China has emerged as a notable player, purchasing 17% of Russian arms while simultaneously fortifying its own defense industry.

Amid this backdrop, Israel’s arms imports have remained stable, contrasting with the trends seen in other regions. However, the U.S. continues to be the largest provider of military aid to Israel, increasing its supply of significant weaponry, including guided bombs, particularly in response to escalating military operations in Gaza and other regional conflicts.